Frequently Asked Questions

Am I eligible?

Yes - if you:

- are a UK resident and an individual donor

- have paid or will pay enough income or capital gains tax* in that tax year (6 April to 5 April)

- make a Gift Aid declaration.

If you are completing an enduring Gift Aid declaration, you must also ensure you paid enough tax to cover any donations made in the previous four years.

*Other taxes such as VAT and council tax do not qualify.

Do I have to sign up to Gift Aid every time I donate?

No - this single Gift Aid declaration will cover any donation you’ve made in the last four years and any future donations you make.

What if I'm a pensioner?

If you pay UK income or capital gains tax, we can claim Gift Aid. If you do not pay UK income tax or capital gains tax, we are unable to claim Gift Aid and you should not complete the Gift Aid declaration.

What if I'm a higher rate taxpayer?

Being a higher rate taxpayer does not change the amount of Gift Aid that we can claim from your donation. We can still only claim the basic rate of tax. If you pay higher or additional rate tax, you can also claim tax relief on gift aid donations, on top of what we claim.

To do this, you must include all your Gift Aid donations on your self-assessment tax return or ask HMRC to adjust your tax code.

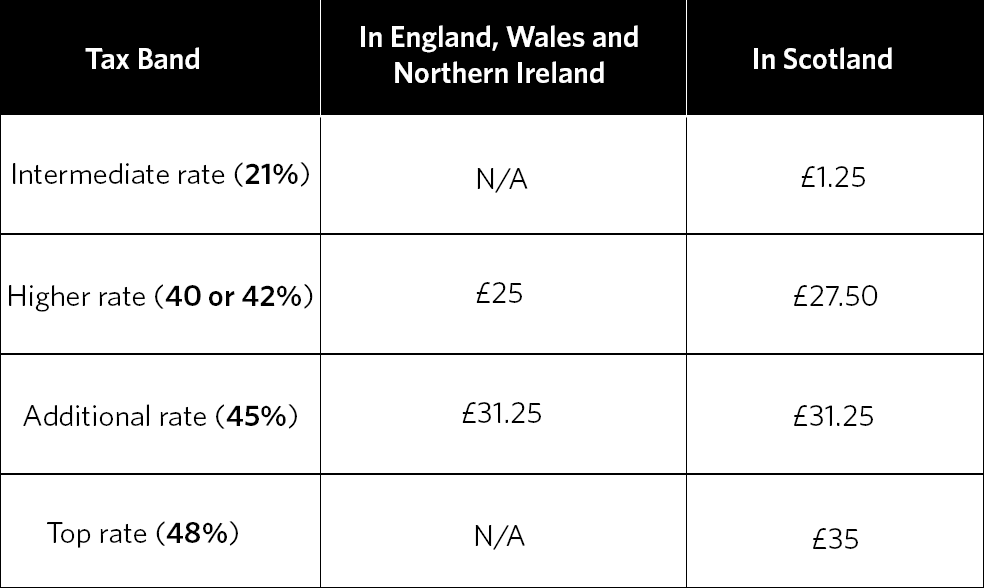

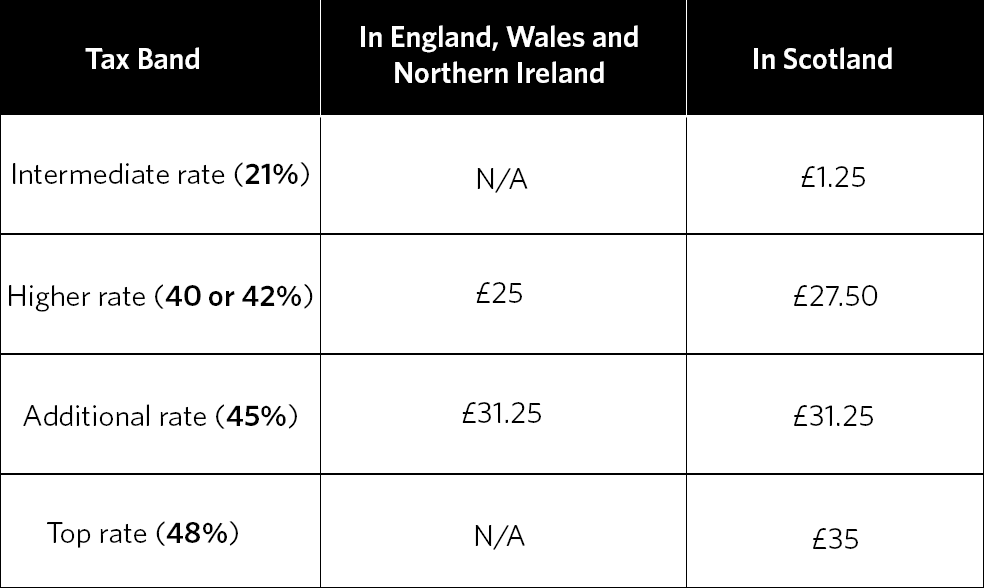

The table below shows the extra tax relief you could claim on a £100 donation:

Intermediate rate (21%) taxpayers can claim £0 in England, Wales, and Northern Ireland, and £1.25 relief in Scotland. Higher rate (40 or 42%) taxpayers can claim £25 in England, Wales and Northern Ireland, and £27.50 in Scotland. Additional rate (45%) taxpayers can claim £31.25 in England, Wales, Northern Ireland, and Scotland. Top rate (48%) taxpayers can claim £35 in Scotland (only applicable in Scotland).

Important information for donors

If we receive more Gift Aid from your donation than tax you have paid, HMRC may ask you to pay the difference.

Can I change my mind?

Yes! If you stop paying tax or you’ve simply changed your mind, you can withdraw your declaration at any time by writing to us at St John Ambulance, 27 St John's Lane, London, EC1M 4BU or by calling 0114 238 7360.